Editor’s note: Future Meat’s technology is based on Prof. Yaacov Nahmias’ research at Hebrew U, and was featured in this recent article: “World’s first lab-grown meat production facility, based on HU research, to open next year.” He also was interviewed in a podcast, where he discussed tissue dynamics and the future of cultured meat production.

Covid-19 has stricken 21,230 American meatpacking workers and killed 77 of them, according to June 3 statistics from the Food & Environment Reporting Network. The pandemic has also hit meatpackers in Australia, Brazil, Canada, France, Germany, Ireland, Spain and the United Kingdom.

Whatever the reason – possibly working closely in cold, humid conditions — the result is widespread meat shortages and price hikes for the foreseeable future.

And in this way, the corona crisis has accelerated the race toward affordable mass production of cultivated meat – also called cell-based, cultured or clean meat – made from harvested animal cells under controlled sterile conditions.

Producing real meat without harming animals or the environment is no fantasy. Thirty cultivated meat startups, five of them Israeli, have emerged over the past seven years. Giant industry players such as Tyson are investing in this quest.

The only missing ingredient was a sense of urgency… and the pandemic provided it generously.

“The crisis emphasized that the meat industry is problematic in many aspects,” says Anya Eldan, general manager of the Israel Innovation Authority (IIA) Start-Up Division.

“Growing meat from cells answers the problem well in so many ways. You can grow it locally, with full transparency, and without the dangerous conditions that led to many meatpacking workers getting sick from the coronavirus.”

Six years ago, the IIA and Israeli food conglomerate Strauss opened Israel’s first food-tech hub, The Kitchen, in Ashdod. Recently, the IIA partnered with other major partners to launch the Fresh Start incubator in Kiryat Shemona and the FoodNxt innovation lab in Migdal HaEmek.

“Each of these has programs in the area of protein alternatives,” Eldan tells ISRAEL21c.

Spurred by the corona crisis, the European Union has pledged €10 billion for alt-protein R&D. Eldan says the IIA will assist Israeli companies in submitting proposals.

It’s happened before

Food security, public health and economic worries are other Covid-related fuels fanning the fire of alternative proteins, says Nir Goldstein, managing director of the Israeli branch of the Good Food Institute.

“Nobody is sure how the coronavirus transferred from animals to human beings. But it’s happened before with avian and swine flu and Ebola because of the close interaction between people and animals in animal agriculture,” says Goldstein.

“Besides viruses, antibiotic resistance is a growing public-health threat. Some 70 to 80 percent of all antibiotics are given to animals raised for food.”

These issues have led to a sharp increase in investment and demand for alternatives to slaughtered meat.

In the first quarter of 2020, alt-protein investment reached about $900 million – the same amount this sector raised in all of 2018. And Q1 was before the full Covid impact hit.

GFI Israel, opened less than a year ago in Tel Aviv, has poured some $1 million into Israeli alt-protein enterprises.

Coinciding with the popularity of Beyond and Impossible meat analogues in the United States, Israeli startups are cooking up plant-based or fermented yeast-based “meats” with a realistic look, taste, smell and texture.

Examples include SavorEat, Redefine Meat, Rilbite, Yeap, Nutrilis and More Foods.

For avowed carnivores, however, nothing can substitute for actual beef, poultry, pork and lamb. Cultivated meat could therefore take a big bite of a market plagued with supply, ethical and environmental problems.

Multinational management consultancy Kearney estimates that cultivated meat will account for 35% of all meat on the market by 2040.

Here’s a look at the five Israeli startups hoping to commercialize cell-based meat.

Future Meat Technologies

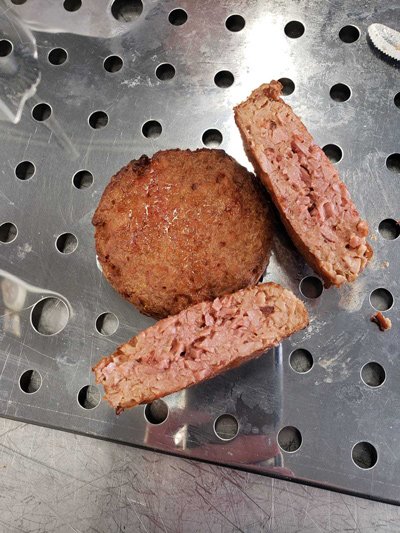

Whereas Aleph Farms is cultivating steak, Future Meat Technologies is cultivating chicken, beef and lamb from fibroblast cells.

“Both technologies can live very nicely together,” Future Meat founder and CSO Prof. Yaakov Nahmias tells ISRAEL21c.

In fact, the fast-growing companies are now neighbors in Rehovot. Future Meat moved recently from the campus of the Hebrew University of Jerusalem to a new facility that will house a production unit.

Founded in 2018 through the university’s Yissum tech-transfer company, Future Meat Technologies developed a bioreactor production system that will enable food producers, meat processers, farmers, food services and retailers to manufacture minced meat and process it locally or in a centralized facility within about two weeks.

“Covid-19 was caused by food practices like the wet markets in Wuhan, and the crisis is driven in part by overreliance on farmed animals,” says Nahmias.

“There is massive interest in plant-based and cell-based meats to limit and secure the food supply during the next epidemic.”

Aleph Farms

Aleph Farms of Rehovot got its start in 2016 at The Kitchen and has raised $14 million from investors including Cargill and Swiss retailer Migros.

Based on tissue-engineering innovations from the Technion lab of Shulamit Levenberg, Aleph Farms aims to finalize development of its thin-cut beefsteak by the end of 2020.

“We will start building our first pilot biofarm in 2021,” cofounder and CEO Didier Toubia tells ISRAEL21c.

“We are not looking to kill the meat industry,” Toubia stresses, but only to fill a need sharpened by the pandemic.

“In the US, due to the shutdown of meat processing and packing facilities, a lot of animals are being slaughtered and thrown away because there are no facilities to process them. In Asia, most of the beef is imported and with the lockdown and travel restrictions there’s been a big disruption in import and export.”

Aleph Farms production sites could be built anywhere, even in large cities, to keep the supply chain steady during any crisis, he says.

BioFood Systems

Meat industry veterans and food scientists Arturo Geifman and Yohai Ben Zikri founded BioFood Systems in Hod Hasharon in 2018.

“We’ve been in the meat industry more than 30 years,” Geifman tells ISRAEL21c. “We realized the damage that animal agriculture has done to the environment, and we also see that the quality of beef today is not good enough.”

Their bootstrapped startup is adapting a technology from the pharma sector to culture beef cost-efficiently from bovine embryonic stem cells.

“Our vision is to make an impact on our ecosystem and a change in the world. That will only happen if carnivores like us eat our product,” says Geifman.

“It’s not going to happen in two or three years. It will take at least 10 years. Meanwhile we will make a vegan meat substitute from plant protein. These revenues can finance the cultivated meat project.”

In the next three months, BioFood Systems expects to finish its R&D phase for burger, meatball and frankfurter products using what Geifman calls “a completely new technology” and a short list of ingredients topped by pea protein. They’ll soon scout out a manufacturing partner in Israel or in Europe.

SuperMeat

Tel Aviv-based SuperMeat, founded in 2015, aims to bring cultivated chicken to the market.

“As one of the first wave companies in the cultured meat space, SuperMeat is proud to have established its production platform, allowing us to produce cultured poultry raw material in a scalable and commercially viable process,” says cofounder Shir Friedman.

SuperMeat is now optimizing its production process both in scale and cost, working with regulatory agencies “to make sure our processes follow the highest standards of food products to reach the market,” she tells ISRAEL21c.

The company is backed by a group of long-term and strategic investors including German chicken producer PHW-Gruppe.

“The coronavirus has brought a lot of attention and interest regarding possible technologies to reduce our reliance on livestock farming and mitigate the risk,” Friedman says. “Cultivated meat is definitely one of the highlights of this category.”

MeaTech

The newest cultivated meat startup in Israel is MeaTech, headquartered in the Rehovot suburb of Ness Ziona.

This company proposes 3D printing beef from umbilical cord cells grown in a bioreactor. Founder and CEO Sharon Fima (formerly head of additive manufacturing company Nano Dimension) estimates this technology will take six to eight years to develop.

MeaTech has some notable personalities involved, such as former Israeli Ambassador to the United States Danny Ayalon and Hebrew University chemist and serial entrepreneur Prof. Shlomo Magdassi.

Founded in January 2019, MeaTech merged with Ophectra Real Estate and Investments in October and now trades on the Tel Aviv Stock Exchange. The company is heading for NASDAQ following a recent $5.8 million private round whose investors include Israeli supermarket magnate Rami Levy and Israeli meat importer Adom, as well as some American investors.